Deep Dive: What the different expense types mean in Expensify and how they work on your report!

Reimbursable, Non-Reimbursable, Billable

Identifying expenses can seem as intimidating as lions and tigers and bears, oh my! But it really isn’t!

Here's a quick recap of the different types of expenses:

- Reimbursable expenses are expenses that were paid with personal money, either cash or credit card, that the company will pay back to the purchaser or person submitting the expense.

- Non-Reimbursable expenses are expenses that were paid with company money, typically a business credit card. These are expenses that the company only needs to track.

- Billable expenses refer to expenses that are incurred that need to be re-billed to a specific client or vendor. These expenses can also be reimbursable or non-reimbursable.

- Expenses paid with a company card that needs to be billed to a client will be a billable and non-reimbursable expense.

- Expenses paid with a personal credit card that the company will reimburse and that needs to be billed to a client will be a billable and reimbursable expense.

First, notice the report total in the upper right of the report when it’s open to view. This total is made up of all the expenses on the report, regardless of type. Below the report total is the breakdown of the subtotals for each expense type on the report. This breakdown only occurs if multiple expense types are on the report.

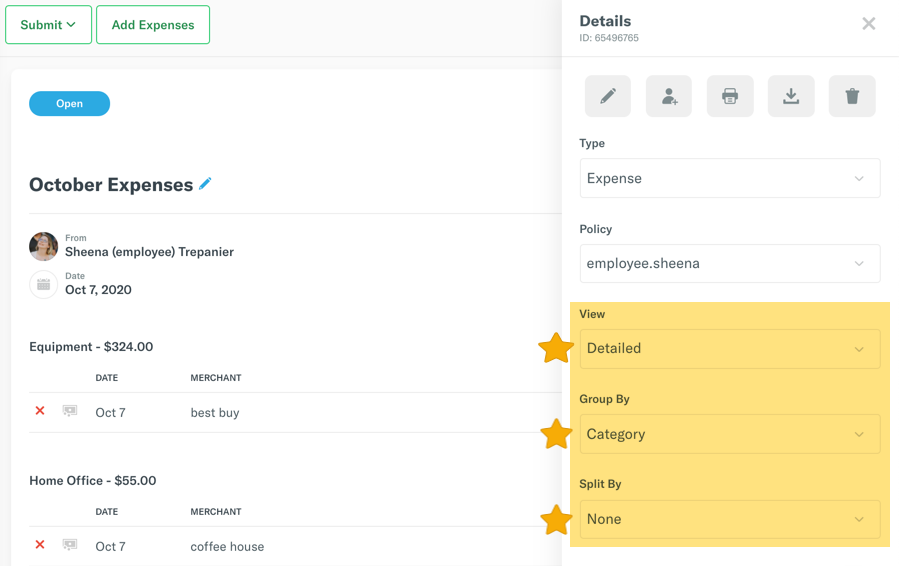

The ability to filter the expense report by category or tag as well as reimbursable and non-reimbursable is located in the Details section of the report. Click the Details button at the top right to expand this section.

Once you switch the View option to Detailed, you can further alter the report view by grouping expenses by tag or category and splitting them up as reimbursable or billable.

Reimbursable expenses are the most common and expected type of expense, when a report only contains reimbursable expenses, you’ll notice that report breakdown is not shown, the whole total is Reimbursable.

If the report includes a negative expense, keep in mind that will offset the report, and be recognized as the opposite of an expense. As an example, compare the two reports shown below. The first one has a negative reimbursable expense called "coffee house".

- Since this expense is negative, it offsets the reimbursable total of the report, decreasing it.

The second report has the same expense, but it's not negative so it adds to the reimbursable total of the report rather than subtracts from it.

Your ability to adjust expenses will depend on the role you play; if they’re your expenses or someone else's, as well as the state of the report and how the expenses were added or imported.