Deep Dive: Expensify Card and NetSuite Auto-Reconciliation: How it works!

If you are using both NetSuite and the Expensify Card, we will automatically reconcile your expenses in NetSuite on a daily or monthly schedule.

Initial setup:

- First, go to your group policy that is connected to NetSuite. On the Export tab, ensure that the user selected as the Preferred Exporter is a policy admin with an email address that belongs to the domain that you will be using for the Expensify Cards, e.g., if your domain is company.com, your Preferred Exporter's email address would need to be email@company.com.

- Next, head to the Advanced tab and ensure that Auto-Sync is enabled.

- Now, head to Settings > Domains > Company Cards > Settings. Use the dropdown menu next to "Preferred policy" to select your group policy that is connected to NetSuite and has Scheduled Submit enabled.

- In the dropdown menu next to "Expensify Card reconciliation account", select your existing NetSuite bank account for reconciliation. This account will need to be the same account that you set in Step 3.

- In the dropdown menu next to "Expensify Card settlement account", select your settlement business bank account (shown in Expensify under Settings > Account > Payments).

How this works with Daily Settlement:

- After the card is set up and the first auto-sync runs, we will create the Expensify Card Liability account and the Expensify Clearing Account within your NetSuite subsidiary general ledger.

- In the same sync, if there are newly posted transactions, we will then create a journal entry with the total of all posted transactions for the day. This will credit the bank account selected and debit the new Expensify Clearing account.

- Once the transactions are approved in Expensify, the report will be exported to NetSuite with each line as individual credit card expenses and an additional journal entry will credit the Expensify Clearing Account and Debit the Expensify Card liability account.

How this works with Monthly Settlement:

- After the first monthly settlement, when Auto-Sync runs, Expensify creates a Liability Account in NetSuite (but no clearing account).

- Each time monthly settlement occurs, Expensify takes the total amount or purchases since last settlement and creates a Journal Entry that credits the settlement bank account (GL Account) and debits the Expensify Liability Account in NetSuite.

- When expenses are approved and exported to NetSuite, Expensify credits the Liability Account and debits the correct expense categories.

Important Note: By default, the Journal Entries created by Expensify are set to the approval level "Approved for posting", so they will automatically credit and debit the appropriate accounts. If you have "Require approval on Journal Entries" enabled in your accounting preferences in NetSuite (Setup > Accounting > Accounting Preferences), this will override that default. Additionally, if you have set up Custom Workflows (Customization > Workflow), these can also override the default. In these cases, the Journal Entries created by Expensify will post as "Pending approval". You will need to approve these Journal Entries manually to complete the reconciliation process.

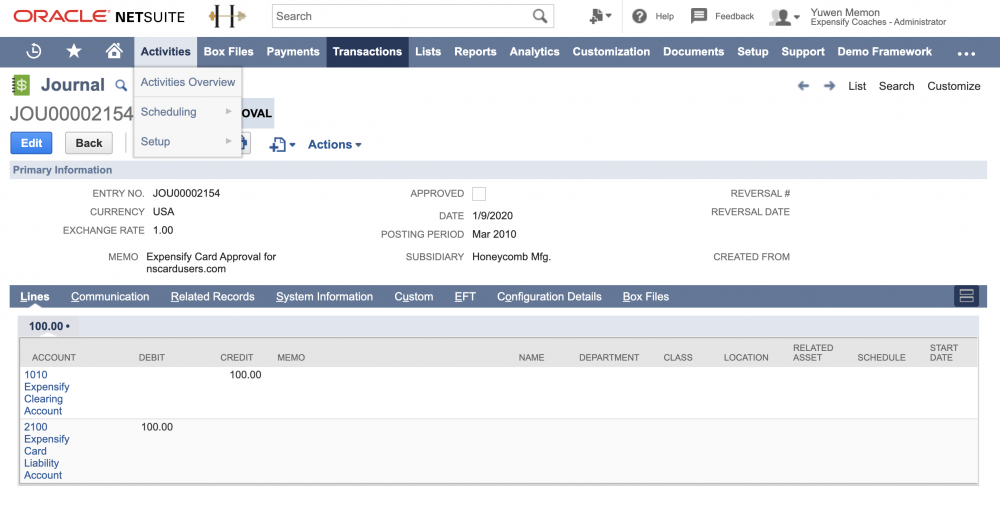

Example:

We have card transactions for the day totaling $100, so we create the following journal entry:

The current balance of the Expensify Clearing account is now $100

The transactions Posts in Expensify so we create the second Journal Entry(ies):

We then reconcile the matching amounts automatically which clears the balance of the Expensify Clearing account.

You will now have a debit on your Credit Card account (increases the total spent) and a credit on the bank account (reduces the amount available). The clearing account has a $0 balance.

Each expense will also create a Journal Entry exactly as we do today, exported upon final approval. This will debit the expense account (category) and contain any other line item data.

This process will occur daily during the NetSuite Auto-Sync to always keep your card reconciled.

Note: Right now, only Journal Entry export is supported for auto-reconciliation. This is set on the Expensify Card, so feel free to set whichever other export option you like for all other non-reimbursable spend in the Configure > Export tab. Look out for Expense Report export in the future!

If Auto-Reconciliation is disabled for your company's set of Expensify Cards, a Domain Admin can set an export account for individual Expensify Cards via Settings > Domains > Company Cards > Edit Exports. The Expensify Card transactions will then export into the selected account. These will always export as a Credit Card charge (in your accounting software), even if the non-reimbursable setting in their accounting configuration is set to another type such as a Vendor Bill.

RELATED ARTICLES

- How-to: Select your Expensify Card Reconciliation Account

- FAQ: Accounting Integration not syncing, how will this affect auto-reconciliation?

Have a question or want to know more? Start a discussion here!