Deep Dive: How Expensify Cards Automatically Reconcile in Xero

This post is for Expensify Card users in the US who are integrated with Xero, and explains how we automatically reconcile Expensify charges with your relevant expense accounts in Xero.

Here’s what to expect when you enable Continuous Reconciliation via your Expensify Inbox, and how it works thereafter.

Setup:

- First, go to your group policy that is connected to Xero. On the Export tab, ensure that the user selected as the Preferred Exporter is a policy admin with an email address that belongs to the domain that you will be using for the Expensify Cards, e.g., if your domain is company.com, your Preferred Exporter's email address would need to be email@company.com.

- Next, head to the Advanced tab and ensure that Auto-Sync is enabled.

- Now, head to Settings > Domains > Company Cards > Settings. Use the dropdown menu next to "Preferred policy" to select your group policy that is connected to Xero and has Scheduled Submit enabled.

- In the dropdown menu for "Expensify Card settlement account", select your settlement business bank account (shown in Expensify under Settings > Account > Payments).

- In the dropdown menu for "Expensify Card reconciliation account", select the GL account from Xero for your settlement business bank account from step 4.

Note: Once you set the preferred policy, you can also use the Expensify Inbox Task below, where you’ll be asked to select the same Business Bank Account in Xero that you’re using to make payments to the Expensify Card. (Top tip: If no accounts are showing, head to Domains and select a preferred policy first).

During the first overnight Auto Sync after enabling Continuous Reconciliation, Expensify will create a Liability Account (Bank Account) on your Xero Dashboard, and if you've chosen Daily Settlement, Expensify will also create a Clearing Account in your General Ledger. We'll also create two Contacts: Expensify and Expensify Card.

Each cardholder’s bank account for Expensify Card transactions will be fixed to the Liability Account Expensify created. (This will not apply to other cards, or to other Non-Reimbursable expenses, which still follow your policy settings).

Reconciling the Expensify Card Daily Settlement:

If you've chosen Daily Settlement, Expensify uses entries to the Clearing Account to reconcile the daily settlement. This is because Expensify bills on posted transactions (you can review these transactions via Settings > Domains > [Domain Name] > Company Cards > Reconciliation > Settlements)

- At the end of each day, or each month on your settlement date, the settlement charge posts to your Business Bank Account.

- Expensify applies the Clearing Account (or Liability Account for monthly settlement) as a Category to the transaction, so it posts there in your GL. Success! The charge is reconciled.

Reconciling bank transactions:

Expensify will pay off the Liability Account with the Clearing Account balance and reconcile bank transaction entries to the Liability Account with your Expense Accounts.

- When transactions are approved and exported from Expensify, bank transactions (Recieve Money) are added to the Liability Account, coded to the Clearing Account. And at the same time, Spend Money transactions are created and coded to the Category field. (Seeing a lot of Credit Card Misc. entries? Add commonly used merchants as Contacts in Xero to export with the original merchant name).

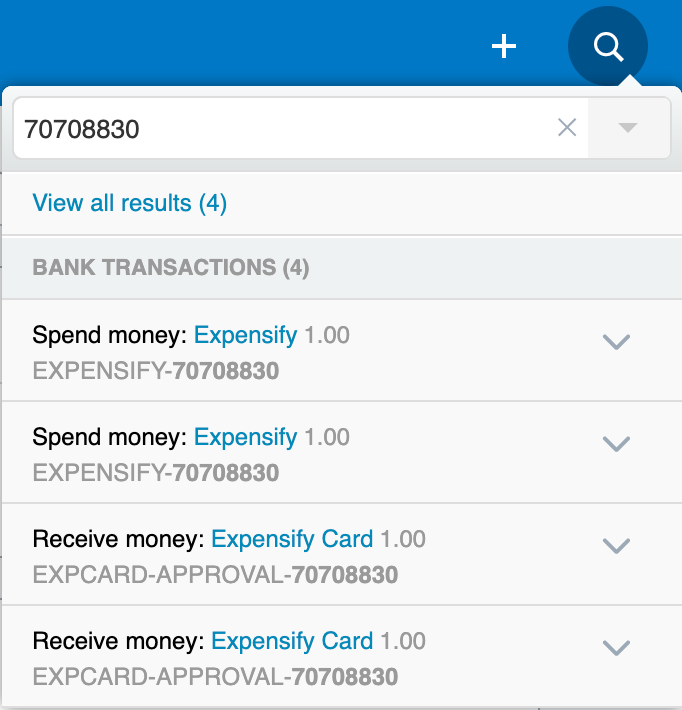

- The balance of the Clearing Account will be reduced and pays off the entries to the Liability Account created in step 1. Each payment to and from the Liability Account should have a corresponding bank transaction that references an expense account. Liability Account Receive Money payments appear with the preface EXPCARD-APPROVAL and the corresponding Report ID from Expensify

- You’ll be able to run a Bank Reconciliation Summary that displays the entries to the Liability Account that reference the individual payments, and entries that reduce the Clearing Account balance to unapproved expenses.

- Important step: enable marking transactions as reconciled in Xero so you can bring your Liability Account balance to 0. When a Spend Money bank transaction in the Liability Account has a matching Receive Transaction, the system works and you can mark both as Reconciled using the functionality hyperlinked above.

Note: If Auto-Reconciliation is disabled for your company's set of Expensify Cards, a Domain Admin can set an export account for individual Expensify Cards via Settings > Domains > Company Cards > Edit Exports. The Expensify Card transactions will then export into the selected account. These will always export as a Credit Card charge (in your accounting software), even if the non-reimbursable setting in their accounting configuration is set to another type such as a Vendor Bill.