[Track] Keeping business and personal expenses separate

Are you using your Individual Policy to track both personal spend and expenses relating to your work as a contractor, freelancer, or sole proprietor? No problem! You can use Expensify to separate business expenses and personal expenses, even when they’re being incurred on the same policy! Here's how:

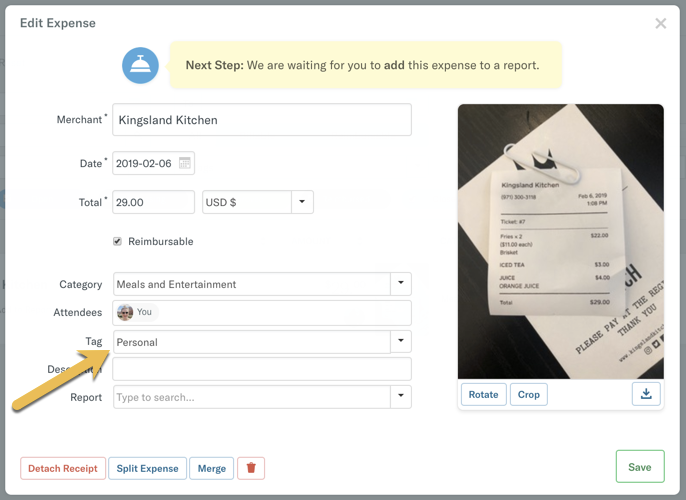

Tag your expenses

You can create separate “business” and “personal” tags and code your expenses accordingly. Then, using filters, you can ensure you’re only seeing the expenses you need!

1. Create the tags by navigating to Settings > Policies > Individual > [Policy Name] > Tags.

2. As you incur expenses, tag them appropriately.

3. Use filters to show only the expenses you want to see. You can use the “Tags” filter on your Expenses page to hide your personal expenses.

4. You can then export your expenses or use Expensify’s baked-in Analytics functionality to generate totals and see where your money is going!

*Pro Tip: Use Expense Rules to automatically tag your expenses.

If you want to learn more about how you can use Expensify to track your business spend, organize and label expenses, and generate totals for end-of-year reporting, check out the Self Employed Training - you can view a video here!